Let us ensure a strong foundation for making the most important and informed business decisions. No longer will you be haunted by the ghosts of https://www.facebook.com/BooksTimeInc past accounting missteps. Instead, you’ll stride confidently into the future, armed with accurate, reliable financial data as your guide. We should make it a habit to go over our financial statements often.

- Say you sent an invoice to your client in April but didn’t receive the payment until June.

- Emphasizing the significance of separating personal and business finances is essential to maintain financial protections.

- It also simplifies tax reporting, enhances financial transparency, aids in tracking deductible expenses accurately, and contributes to better overall financial management.

- With the accrual method, you record expenses when the service or product is received and income when the sale occurs.

- Any LLC can choose to be treated like a corporation for tax purposes by filing Form 8832 and checking the “corporate tax treatment” box.

Simplify LCC accounting with the right bookkeeping software

This helps catch any discrepancies and ensures that your records are accurate. Neglecting this task can lead to serious consequences for your LLC. Mark your calendar with important dates for estimated tax payments, annual filings, and payroll taxes. Using accounting solutions can methods of accounting for llc help you keep track of these deadlines and avoid any last-minute stress. LLCs can be taxed as a sole proprietorship, partnership, or corporation.

The Advantages of Accounting Packages

- This empowers them to make informed decisions based on real-time data rather than relying on outdated or incomplete information.

- With our powerful financial guidance and support, your business won’t just make it, it will thrive.

- Separating personal and business finances maintains legal protection provided by the LLC structure.

- Outsourcing accounting for LLC can offer benefits such as cost savings, access to professional expertise, and reduced workload.

- The accrual method provides a more accurate monthly picture of your business’s expenses and revenue.

- As an LLC owner, you’ll have to attach a Schedule C for reporting business income and a Schedule SE for paying self-employment tax.

Outsourcing your bookkeeping is more affordable than you would think. We save you money the moment you hire us by cutting out the expensive cost of hiring an in-house CFO. “These guys are worth every penny, simply for the lowered stress in my life with some of the forensic accounting and ongoing accounting they do to keep my business books up to date.” Your new accounting service can be supported by financial forecasting by an in-house actuary as well. Take a deep dive into your financial potential and unlock the strategy to get there.

Essential Bookkeeping Tasks for LLCs

On the other hand, in-house bookkeeping provides greater control and customization of processes according to the company’s specific needs. It allows for direct supervision of the accounting tasks and immediate access to financial data. Robust systems for tracking all business-related expenses are crucial for effective income management within an LLC. Categorizing these expenses meticulously is essential as it facilitates budget planning and tax preparation. By using accrual-based methods, LLC owners can track long-term financial trends more accurately. With the accrual method, you record expenses when the service or product is received and income when the sale occurs.

Understanding LLC Tax Obligations

- Ohana Accounting LLC is the partner small business owners count on for accurate accounting services, smart bookkeeping solutions, and valuable tax strategies.

- Clear boundaries between personal and business assets must be established to avoid confusion regarding ownership during audits or legal proceedings.

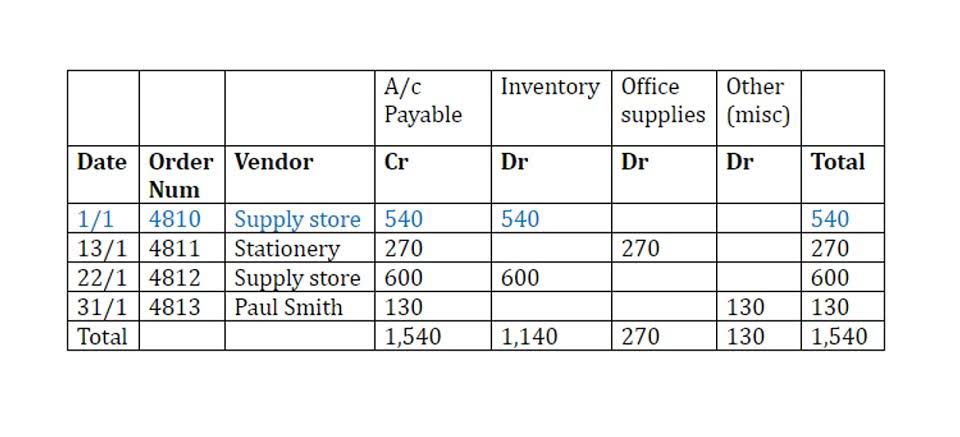

- Similar to a personal checkbook, this record shows the daily transactions of the business.

- I’ve worked in the collegiate, rental properties, and small business industries managing the books at the strategic and day-to-day level.

- Keeping our financial records accurate is crucial for making smart decisions and staying on top of tax rules.

Say you sent an invoice to your client in April but didn’t receive the payment until June. You would record this income in June if you’re using the cash method and in April if you’re using the accrual method. By taking into account your communication style, organizational methods, and comfort with technology, we discover the ideal approach for you. Our certification in bookkeeping enables us to navigate various platforms, ensuring we find the best fit for your needs, not ours. I’m what are retained earnings a certified QuickBooks ProAdvisor and the owner of Accountable.